A sell-off occurs when a large number of traders or investors sell a currency pair in a short period. This selling pressure causes prices to drop rapidly, sometimes triggering panic in the market.

often (but not always) due to bad or unexpected news. It is described as a short period of intense selling triggered by declining prices.

Sell-offs are also known as “dumping” because traders usually try to get rid of their holdings as quickly as possible rather than as part of a regular trade.

This surge in selling volume caused prices to plummet even more sharply.

In This Post

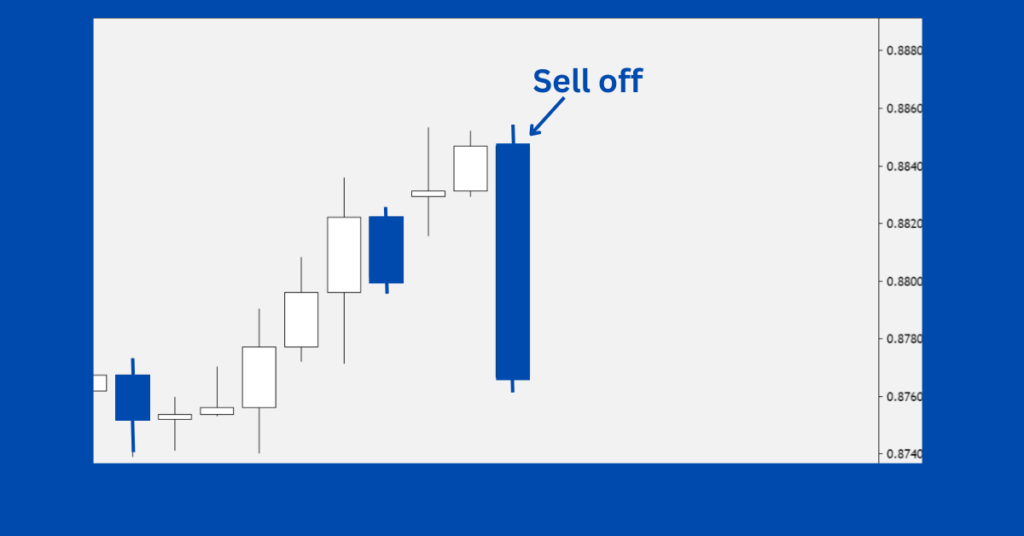

Example of a Sell-Off:

If bad economic news is released about the U.S. economy, traders may start selling USD pairs quickly. This could result in a sharp decline in USD value, creating a sell-off.

Conversely, if a dump occurs in EUR/USD after an unexpectedly dovish statement by the BOE, its central bank, this means that forex traders who were long EUR/USD decided to exit their positions as quickly as possible since their bullish view on EUR has now been shattered.

Causes of a Sell-Off in Forex Markets

The idea of supply and demand governs sell-offs.

If a large number of traders decide to sell their holdings and there is no corresponding increase in buyers, the price falls and as such, supply outnumbers demand in this case.

Sell-offs are a reflection of market psychology, there are other factors that can trigger a forex sell-off and they include:

Economic Data Releases

Weak GDP reports, rising unemployment, or lower consumer spending can reduce confidence in a currency.

Interest Rate Changes

Central banks lowering interest rates can lead to a currency sell-off.

Geopolitical Events

Wars, political instability, or trade tensions can cause investors to dump riskier currencies.

Market Panic

Fear-driven reactions, often amplified by news and social media, can accelerate a dump.

Central Bank Actions

Unexpected policy changes by central banks can lead to rapid currency depreciation.

How to Identify a Sell-Off

Traders can spot sell-offs by analyzing price action and technical indicators. Some of the method of identifying it includes:

Large Red Candlesticks

Sharp downward moves with high volume indicate strong selling pressure.

Increased Trading Volume

A spike in volume confirms widespread selling activity.

Break of Support Levels

If a currency falls below a key support level, a dump may continue.

Overbought/Oversold Indicators

RSI dropping below 30 signals extreme selling pressure.

News and Economic Reports

Negative news can trigger sudden market downturns.

Conclusion

A selloff is a rapid and sustained sale of a large volume of securities, leading to a decline in its price.

It may be caused by various factors, such as a report of declining earnings, the threat of new technologies, natural disasters, or an increase in the price of raw materials.

Selloffs are generally short-lived and prices will stabilize quickly once the triggering event or news is assimilated into the market.

Before trading a dump, always confirm signals with technical analysis and stay updated on market news.

Related Term