In the forex market, order imbalance indicators can give traders a good understanding of where the market might be headed next.

If there are significantly more buy orders than sell orders, for instance, we might see an upward price movement.

These indicators are important for understanding market sentiment and can be a game-changer when it comes to timing your trades.

In This Post

What is Order Imbalance?

Order imbalance, in simple terms, happens when there are more buy orders than sell orders, or vice versa, in the market.

This difference between buy and sell orders creates a kind of “imbalance,” which often triggers price movements.

If you’ve ever wondered why a currency pair suddenly spikes or drops, there’s a good chance it’s due to a large order imbalance.

The forex market is driven by supply and demand, just like any other market. When demand (buy orders) outweighs supply (sell orders), the price typically goes up.

On the other hand, when there’s an excess of sell orders, the price usually drops. Order imbalance indicators help you see these dynamics in real time, giving you an edge in predicting where the market might move next.

Importance of Order Imbalance in Forex

So, why does order imbalance matter? It’s all about spotting opportunities and managing risk.

Order imbalance is one of the driving forces behind price volatility. When there’s a sudden surge of buying or selling activity, it can lead to significant price shifts—sometimes within minutes.

By using order imbalance indicators, traders can better understand market volatility and take advantage of these price swings.

And here’s the exciting part: traders who can spot order imbalances before others have a huge advantage.

You can use these indicators to identify key moments to enter or exit the market, helping you stay ahead of big price movements.

Whether you’re looking to ride a trend or avoid market noise, understanding order imbalances can give you the insight you need to make smarter trading decisions.

Types of Order Imbalance Indicators

1. Volume-Based Indicators

Let’s kick things off with volume-based indicators. These indicators focus on trading volume, which shows the total number of buy and sell orders over a specific time period.

In the world of forex, tracking volume can give you a clear idea of how much buying or selling pressure is in the market, revealing potential imbalances.

Volume Profile: This indicator shows how much trading occurred at each price level, helping you spot areas where buy or sell orders are piling up.

Accumulation/Distribution: This one helps you gauge the overall market sentiment by analyzing whether traders are accumulating (buying) or distributing (selling) positions.

2. Price Action Indicators

Next up are price action indicators, which focus on analyzing actual price movements to detect order imbalances.

Rather than looking at volume, price action traders watch for specific patterns and behaviours that suggest an imbalance between buyers and sellers.

Candlestick Patterns: These are classic indicators in forex. For example, a bullish engulfing pattern might signal that buyers are overtaking sellers, showing an imbalance in favour of a price increase.

Support and Resistance Levels: When price hits a significant support or resistance level, it often reveals an imbalance, either causing a reversal or a breakout.

3. Order Flow Indicators

Order flow indicators give you a front-row seat to the inner workings of the market by showing you the real-time flow of buy and sell orders. These tools are a bit more advanced but incredibly useful for spotting large-order imbalances.

Order Book: The order book displays current buy and sell orders, allowing you to see where the market is likely to move next based on the imbalance between supply and demand.

Depth of Market (DOM): This indicator gives a similar view, showing the number of buy and sell orders at different price levels. A heavy imbalance on one side can signal an impending price shift.

4. Market Sentiment Indicators

Finally, we have market sentiment indicators, which help you gauge the overall mood of the market.

While these aren’t direct order imbalance indicators, they give you an idea of how bullish or bearish traders are, which can indirectly highlight potential imbalances.

Commitment of Traders (COT) Reports: These reports show how large institutional traders are positioned, giving you a sense of the broader market sentiment.

Trader Sentiment Indicators: Tools that show the ratio of long vs. short positions can also help you spot where the majority of traders are, revealing potential imbalances.

How to Use Order Imbalance Indicators in Trading

1. Know Order Imbalance

Now that you know about the types of order imbalance indicators, how do you actually use them? The first step is identifying the imbalance.

Start by monitoring key indicators like the Volume Profile or Order Book to see if there’s a sudden shift in buying or selling activity.

If you notice a significant disparity—like a huge cluster of buy orders and very few sell orders—you’ve likely found an imbalance.

At the same time, watch price action for signals like candlestick patterns or support/resistance levels being tested.

2. Entry and Exit Strategies

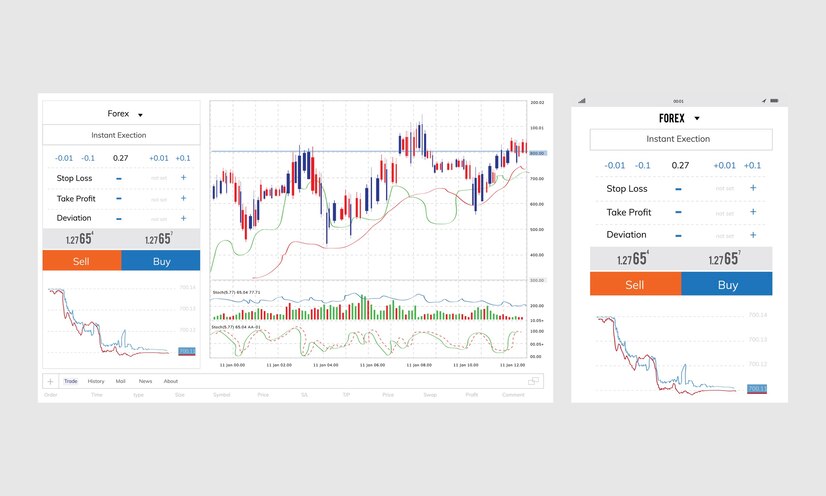

Once you’ve spotted an imbalance, you can use this information to time your trades. Entry strategies based on order imbalances often involve buying or selling when the imbalance is likely to drive price movement in your favour.

For instance, if you see a significant order imbalance where there are far more buyers than sellers, you might want to enter a long position before the price moves upward.

For exit strategies, you can set stop-loss and take-profit levels by watching for a balance shift, indicating the trade is losing momentum.

2. Combine Indicators

The real magic happens when you combine multiple indicators to get a clearer picture of the market.

For example, using a Volume Profile alongside candlestick patterns can help you confirm whether a large imbalance is about to cause a breakout or reversal.

Using a combination of volume-based, price-action, and order-flow indicators can greatly improve the accuracy of your trades.

The idea is to look for alignment between different types of indicators, ensuring that the imbalance you’re seeing is significant and likely to affect prices.

Advantages of Order Imbalance Indicators

1. Enhanced Market Understanding

One of the biggest advantages of using order imbalance indicators is the deep insight they provide into the underlying market dynamics.

These indicators allow traders to see beyond just price movements—they offer a glimpse into the actual tug-of-war between buyers and sellers.

With this knowledge, you can get a clearer picture of trader behaviour and an understanding of when big players are entering or exiting the market.

Insights into market dynamics: By tracking order imbalances, traders can detect shifts in buying or selling pressure before they reflect in price changes, offering a valuable advantage.

2. Improved Decision-Making

Armed with these insights, order imbalance indicators help traders make more informed decisions.

Instead of relying solely on price charts or traditional technical indicators, you’re adding another layer of depth to your analysis.

Whether you’re determining the right moment to enter a trade or figuring out when to lock in profits, these indicators can be the difference between reacting too late and making timely, profitable moves.

How indicators help traders: With clearer signals from order imbalances, you can avoid guessing or chasing the market, giving you more confidence in your trading strategy.

3. Risk Management

Risk is a constant companion in forex trading, but order imbalance indicators can act as a guide to help you manage that risk.

By identifying large imbalances that signal a potential price movement, you can adjust your position size, set more accurate stop-loss levels, and ensure you’re not caught off-guard by unexpected market swings.

Managing risk: Spotting order imbalances early helps traders avoid entering trades when the market is overly one-sided, reducing the chances of getting trapped in volatile conditions.

Challenges and Limitations of Order Imbalance Indicators

1. Market Noise

As valuable as they are, order imbalance indicators aren’t perfect. One major challenge is the issue of market noise—the random, small fluctuations in price and order flow that can obscure the real picture.

If you’re not careful, these small movements can lead to false signals, causing you to misinterpret what’s actually going on in the market.

Impact of noise: Especially in high-frequency trading environments, it’s crucial to filter out noise to avoid mistaking insignificant shifts for meaningful imbalances.

2. Misinterpretation of Data

Another risk is the potential for misinterpreting the data. Order imbalance indicators show you a snapshot of the market, but it’s up to you to interpret what that means.

If you don’t have a solid understanding of how these imbalances relate to broader market conditions, it’s easy to make mistakes.

For instance, not every order imbalance will lead to a major price shift—it depends on various factors like overall market sentiment and external economic events.

Risks of incorrect analysis: Misreading the imbalance could lead to entering trades at the wrong time, which might increase losses or missed opportunities.

3. Dependence on Market Conditions

Lastly, the effectiveness of order imbalance indicators can be heavily influenced by market conditions. During periods of low liquidity or extreme volatility, the reliability of these indicators can diminish.

For example, in highly volatile markets, large imbalances may appear but quickly reverse, making it difficult to act on them without getting whipsawed by rapid price changes.

Market condition dependency: Traders need to be mindful of how the broader market environment impacts the performance of these indicators, ensuring they adapt their strategies accordingly.