What exactly is market depth analysis? Think of it as a behind-the-scenes look at the Forex market.

While most traders are just seeing price charts and trends, market depth reveals the actual supply and demand at various price levels. It’s like having a zoomed-in view of all the buy and sell orders waiting to be executed.

This “depth” shows you where traders are placing their bets, offering a clear visual of the number of buy (bid) and sell (ask) orders lined up at each price point.

Now, imagine being able to see not just the current price, but the layers of orders above and below that price.

That’s what market depth offers—it’s a powerful tool to understand what’s really happening beneath the surface of price movements.

So why does market depth matter, especially in Forex trading? In one word: insight. By analyzing market depth, you can measure liquidity, which is the ability to buy or sell without causing a significant price change.

The more liquidity, the easier it is to execute large trades without moving the market too much.

Market depth also gives you a window into market sentiment you can tell if the market is leaning bullish or bearish by seeing where the bulk of orders are placed.

But here’s where it gets even more interesting: market depth can help you predict short-term price movements.

When there’s a cluster of large buy orders at a certain price level, it might act as support, keeping the price from falling further.

A wall of sell orders can act as resistance. Having this knowledge can give you a real edge in making informed trading decisions.

In This Post

Components of Market Depth

Market depth isn’t just one big lump of data—it’s made up of several key components that give you different insights into the market.

1. Order Book

The order book is where all the action happens. It’s a running list of all the buy (bid) and sell (ask) orders at different price points.

Think of it as a scoreboard, showing who’s willing to buy or sell and at what price.

Understanding the balance of bids and asks helps you see where the market is headed, whether it’s leaning more towards buying or selling pressure.

2. Levels of Liquidity

Market depth also shows the liquidity at each price level. In simple terms, liquidity is how many buy and sell orders exist at each price point.

A high level of liquidity means there are lots of orders waiting to be filled, while low liquidity could mean a more volatile market where price moves can happen more rapidly.

3. Bid-Ask Spread

The bid-ask spread is the difference between the highest price someone is willing to buy (bid) and the lowest price someone is willing to sell (ask).

This is a part of market depth because a tight spread indicates a healthy, liquid market, while a wide spread could mean a lack of activity or uncertainty.

Knowing this spread helps you get a clearer sense of market sentiment and trade execution.

Market Depth Levels

Market depth data can be broken down into different “levels,” depending on how much information you want to see:

1. Level I Data

This is the most basic form of market depth. It shows you the best available bid and ask prices, along with how much depth (volume) exists at those prices. It’s a quick snapshot but doesn’t give you the full picture.

2. Level II Data

Here’s where things get a bit more detailed. Level II data offers a broader view of the order book, showing you multiple bid and ask prices beyond just the best one.

This gives you insight into the next layers of liquidity and allows for better predictions about how the market might behave.

3. Level III Data

For the truly advanced traders out there, Level III data dives into the actual intentions behind orders.

It gives you visibility into the activity of market makers, those who provide liquidity and influence price movements. If you want to see not just where the orders are, but why they’re there, Level III data is your go-to tool.

Market Depth Analysis Techniques

When it comes to making informed trading decisions in Forex, market depth analysis is your secret weapon. Let’s dive into some effective techniques that can help you understand market behaviour and anticipate price movements.

1. Order Book Analysis

Order book analysis is all about getting up close and personal with the market’s inner workings. By studying the distribution of buy and sell orders at different price levels, you can uncover valuable insights.

You’ll want to familiarize yourself with where orders are stacked. Are there more buyers than sellers at a certain price? Or vice versa? By analyzing this distribution, you can calculate market sentiment and potential price movements.

Keep an eye out for large blocks of orders. These can act like walls in the market—when they’re hit, they can cause significant price fluctuations.

Knowing where these blocks are located can help you anticipate potential support and resistance levels, allowing you to position yourself wisely.

2. Liquidity Pools and Price Levels

Liquidity pools are crucial areas of interest for any trader. These are spots in the market where a high volume of orders exists, creating significant liquidity.

By spotting these liquidity pools, you can understand where the market is likely to bounce or stall. These levels often act as critical support or resistance, so recognizing them can improve your trading strategy.

Once you’ve identified these areas, you can use them to predict price movements. If a liquidity pool is robust, the price may struggle to break through it, leading to reversals or consolidations. This foresight can help you make informed trades based on where the market is likely to move.

3. Bid-Ask Imbalance

The bid-ask imbalance is another critical concept to grasp. It refers to the disparity between the number of buy orders (bids) and sell orders (asks) at specific price levels.

If you notice that there are significantly more buy orders than sell orders at a given level, it’s a sign of strong buying pressure.

A higher number of sell orders can indicate selling pressure. This imbalance can signal upcoming price movements, giving you an edge in your trading strategy.

As you monitor changes in these bid-ask imbalances, you can start to forecast market trends. If the imbalance shifts dramatically, it may indicate a potential trend reversal or continuation, allowing you to adjust your strategy accordingly.

4. Spoofing and Layering Detection

Spoofing and layering are manipulative tactics some traders use to influence market perception. Understanding how to spot these deceptive practices is essential for protecting your trades.

Spoofing involves placing large orders that are never intended to be filled, creating a false sense of demand or supply.

Layering is similar but involves placing multiple smaller orders at different price levels to create the illusion of activity.

Learning to recognize these tactics can help you avoid falling for market tricks.

Use market depth analysis to watch for sudden changes in order flow, like a sudden influx of large orders that disappear quickly.

By being aware of these tactics, you can better navigate the market and make informed trading decisions.

Practical Applications of Market Depth Analysis

1. Scalping and High-Frequency Trading

If you’re a scalper or involved in high-frequency trading, market depth can be a game-changer.

Short-term traders thrive on small price movements, and market depth can help you identify these fleeting opportunities.

By analyzing order flow, you can find tight liquidity zones where you can enter and exit trades quickly for profit.

Focusing on these tight zones allows you to capitalize on quick price changes without getting caught in larger market fluctuations. This precision can be the difference between a profitable trade and a missed opportunity.

2. Swing and Position Trading

For those who prefer swing or position trading, market depth offers a different set of advantages.

Using market depth to pinpoint significant support and resistance levels can improve your entry and exit points.

By recognizing where large orders accumulate, you can make strategic decisions based on potential price reversals or breakouts.

Look for patterns in order flow that indicate accumulation or distribution. These long-term trends can help you ride bigger price moves, maximizing your potential profits.

3. Day Trading with Market Depth

Day traders can greatly benefit from real-time tracking of order flow.

By monitoring market depth throughout the day, you can fine-tune your entry and exit points, ensuring you’re making the most of market conditions.

Don’t forget to integrate market depth with your favourite technical analysis tools! By combining both, you can enhance your trading decisions, confirming signals and improving your overall strategy.

Trading Platforms that Offer Market Depth

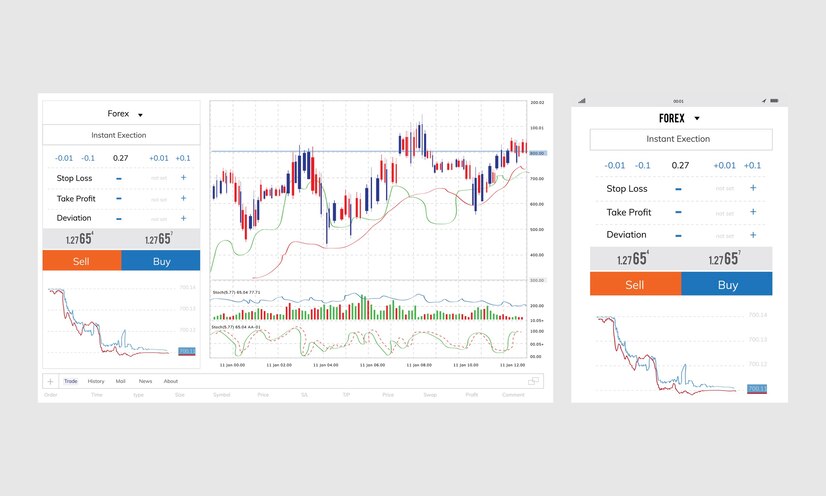

Not all trading platforms provide market depth features, so it’s essential to know which ones stand out.

Some top-tier platforms that offer robust market depth tools include MetaTrader, NinjaTrader, and TradingView. These platforms give you access to real-time order book data, allowing you to visualize supply and demand at different price levels.

Key Features to Look For

When choosing a platform, prioritize ones that offer:

Real-time data: Ensure that the data is live and not delayed.

Customization: Look for platforms that allow you to tailor the display to your preferences, like adjusting the color schemes or highlighting significant price levels.

User-Friendly Interface: A simple yet effective interface is crucial for quick decision-making during active trading.

Market Depth Software

If you’re looking for more specialized tools, standalone market depth software might be the answer.

1. Comparison of Software

There are various software options available, each with unique features. For example, platforms like Bookmap focus specifically on market depth visualization and can provide an edge for traders seeking detailed insights.

2. Customization Options:

With standalone software, you can often filter orders by size, volume, or price levels to focus only on what’s most relevant to your trading strategy. Customization tools allow you to ignore “noise” in the market, so you’re only seeing the orders that matter most.

Data Feeds for Accurate Market Depth

A key component of any market depth analysis is the data you’re working with. Without reliable data, even the best software won’t help.

Real-time data accuracy is crucial for market depth analysis. If your data is delayed or inaccurate, you could be making trading decisions based on an outdated view of the market, which can lead to costly mistakes.

Some of the most trusted data providers in the industry include CQG and Rithmic. These providers are known for offering real-time, reliable data that can help you stay on top of the fast-moving Forex market.

Challenges of Market Depth Analysis

While market depth analysis offers numerous benefits, it also comes with its fair share of challenges. Being aware of these limitations can help you avoid potential pitfalls.

1. Data Accuracy and Latency Issues

One of the biggest challenges with market depth analysis is data accuracy and latency.

Sometimes, the order book data you’re seeing might not reflect real-time market conditions. This can happen due to technical delays or data feed issues, leading to poor trading decisions based on outdated information.

Latency, or the delay between receiving data and acting on it, can be a significant issue in fast-moving markets. Even a small delay can distort the market depth, causing you to miss key opportunities or, worse, enter a trade based on outdated info.

2. Manipulation of Market Depth

The Forex market isn’t immune to manipulative tactics like spoofing and layering.

Some traders, especially large institutional players, can place massive fake orders to mislead others about market conditions. They cancel these orders before they’re executed, leaving smaller traders confused and at a disadvantage.

To avoid being misled, it’s crucial to combine market depth analysis with other tools like technical indicators and price action. This way, you can verify whether large orders are genuine or just an attempt to manipulate the market.

3. Overreliance on Market Depth

It’s tempting to rely solely on market depth for trading decisions, but doing so can be risky.

While market depth provides excellent real-time insights, it’s not the full picture. It should be used in conjunction with technical and fundamental analysis.

Market trends, economic reports, and other external factors can influence price movement beyond what market depth shows.

The best traders know how to balance various forms of analysis. Relying too much on any single method, including market depth, can lead to poor decision-making.

Market Depth with Other Analysis Techniques

Market depth analysis is a powerful tool on its own, but combining it with other forms of analysis can significantly enhance your trading strategies.

Here’s how you can involve market depth with various techniques to maximize your insights.

1. Market Depth and Technical Analysis

Market depth adds an extra layer of detail when analyzing key price levels.

By looking at the order book, you can see where clusters of buy or sell orders are sitting, which can act as hidden support or resistance points. These areas help validate traditional technical analysis.

Breakouts, for example, are often tricky to trade. Market depth can help confirm a breakout by showing whether there is enough buying or selling pressure to push the price beyond the support or resistance zone.

A large imbalance of orders on one side can be a clear indicator that a breakout is legitimate.

2. Market Depth and Volume Analysis

Market depth pairs well with volume indicators like the Volume Profile or VWAP (Volume Weighted Average Price).

These indicators help you see the volume at different price levels, and market depth adds real-time data on where buy and sell orders are stacked.

Volume Profile, for instance, shows you where most of the trading action occurred, creating high-volume nodes.

Market depth helps you monitor how liquidity and order flow are changing around these critical areas, giving you a better understanding of potential price movements.

3. Market Depth and Order Flow Analysis

Order flow analysis focuses on tracking where and when orders are being filled. Market depth complements this by showing where large orders are sitting in the market, helping traders anticipate when and where price shifts may happen based on supply and demand imbalances.

With order flow strategies, you often look for price trends or reversals. By analyzing market depth, you can confirm whether the order flow data aligns with the actual distribution of buy and sell orders.

For example, if you see a large cluster of buy orders disappearing, it could indicate a weakening trend and a potential reversal.

Frequently Asked Questions

1. What is the difference between Level I and Level II market depth?

Level I market depth provides basic information, such as the best available bid and ask prices, along with the associated volume at those prices.

Level II goes deeper, offering a broader view of the order book, including multiple price levels and the corresponding buy and sell orders, giving traders more detailed insights into market liquidity and potential price movements.

2. Can market depth analysis be useful for beginners?

Yes, market depth can be useful for beginners as it provides a clearer picture of where buy and sell orders are sitting, helping new traders understand liquidity and market sentiment.

Although it may seem complex at first, learning to read market depth can significantly enhance your understanding of how prices move.

3. How can market depth help me avoid false breakouts?

By looking at the order book, market depth allows you to see where large clusters of buy or sell orders are placed.

If a breakout occurs but there is not enough order volume to sustain the move, it could be a false breakout.

Market depth helps you verify if there’s sufficient buying or selling pressure to confirm the breakout.

Conclusion

Market depth is a tool that allows traders to see beyond price charts and gain deeper insights into liquidity and order flow.

By analyzing the levels of buy and sell orders at various price points, traders can better understand the forces that drive price movements, identify key areas of support and resistance, and predict short-term fluctuations.